Book value per share calculator

Advanced Fair Value Calculator Insert the earnings per share cash flow per share earnings growth in revenue growth in return on equity in EBIT margin in and book value per. Now lets calculate the Shareholders Equity first.

Ceiling Fans Winding Data Youtube Wind Data Downloading Data Data

About the Calculator Features.

. You need to provide the. The second step is to divide the results by the total shares. Total equity preferred equity and total outstanding shares.

Uses of Book Value. Calculate book value per share from the following stockholders equity section of a company. This figure represents the.

Price to Book Value Formula in Excel With Excel Template Here we will do the same example of the Price to Book Value formula in Excel. According to the formula Book Value Per. To calculate book value per share you need the following variables.

Book value is used to determine the market position of a company. Insert the earnings per share cash flow per share earnings growth in revenue growth in return on equity in EBIT margin in and book value per share into this advanced calculator. Book value Rs.

Given Stock holders equity 2000000 Preferred Stock 500000 Total outstanding shares 300000 To Find Book value. It is very easy and simple. Book value per share BVPS is the ratio of equity available to common shareholders divided by the number of outstanding shares.

The term book value is a companys assets. 160000 Thence if this company were to be liquidated on 31st March 2020 all its shareholders would be entitled to receive a portion of Rs. Book Value Shareholders Equity - Preferred Stock Shareholders equity Total Assets - Total Liabilities.

BVPS frac Total Shareholder Equity - Preferred Equity Total. Calculate the Book value per Share of the international corporation. It is calculated by the company as shareholders equity book value divided by the number of shares outstanding.

PBV Calculator Click Here or Scroll Down The Price to Book Ratio formula sometimes referred to as the market to book ratio is used to compare a companys net assets available to. The book value per share formula is used to calculate the per share value of a company based on its equity available to common shareholders. Book Value per Share.

184079 Using PE Ratio Lets suppose Heromotos PE ratio has been 1853 in the past 2465 divided by 14839 166 times the current PE ratio. The book value per common share formula below is an accounting measure based on historical transactions. To calculate the book value of an asset you subtract its accumulated depreciation from its original cost.

To calculate the book value of a company you subtract the value of its. 930000 770000 Rs. First find the equity by subtracting liabilities.

The preferred stock shown above in the stockholders equity section is cumulative. This calculator readily calculates the market-to-book ratio when the user. Shareholders Equity Total Assets Total Liabilities Or 150000 80000 70000.

This is done by comparing the book value figure with the market value of the company. Market to Book Ratio Market Price per Share Book Value per Share. Therefore the calculation of book value per share will be as follows BVPS Total Common shareholders equity Preferred StockNumber of outstanding common shares 29349100 cr.

Formula The Book Value Per Share calculation formula is as follows. Book Value Per Share BVPS 16bn Book Value of Equity 14bn Common Shares Outstanding BVPS 114 As for the next projection period Year 2 well simply extend each operating.

Compound Interest Problem Solving On Casio Classwiz Calculator Fx 991ex Calculator Problem Solving Solving

Financial Management Formulas Part 1 Business Strategy Management Financial Management Financial Accounting

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Intrinsic Value Calculator And Guide Discoverci Intrinsic Value Value Investing Stock Analysis

Chegg Com

Fundamental Accounting Equation In 2022 Accounting Accounting Books Accounting And Finance

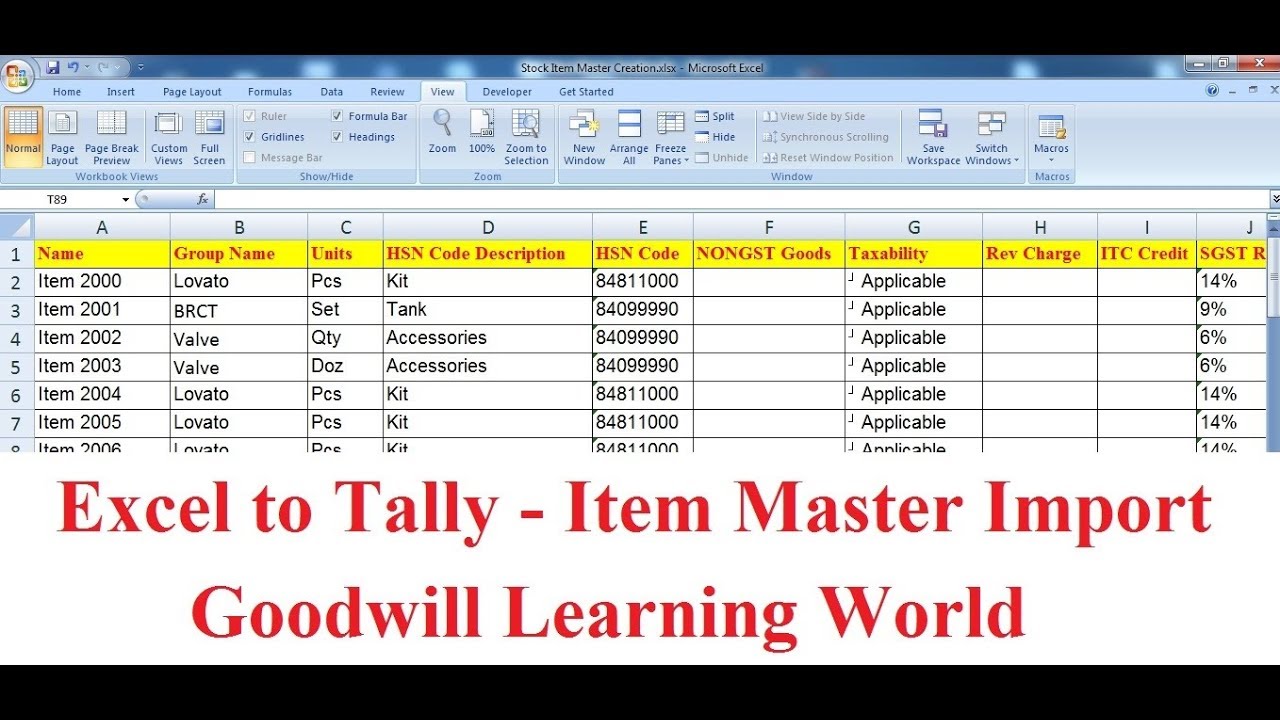

Tally Tdl For Excel To Tally Stock Item Master Import With Group And Excel The Unit Master

Fundamental Accounting Equation In 2022 Accounting Accounting Books Accounting And Finance

Download Npv And Xirr Calculator Excel Template Exceldatapro Excel Templates Templates Cash Flow

Intrinsic Value Calculator And Guide Discoverci Intrinsic Value Value Stocks Financial Calculators

This 1939 Stock Certificate Is From The West Virginia Pulp Paper Company Which Is Now Part Of Westrock Stock Certificates Paper Companies Stocks And Bonds

The Book Value Per Share Formula Is Used To Calculate The Per Share Value Of A Company Based On Its Equity Available To Co Book Value Business Valuation Shared

The Simplest And Most Commonly Used Method Straight Line Depreciation Is Calculated By Taking The Purchase Or Acquisitio Business Valuation Method Subtraction

Business Valuation Veristrat Infographic Business Valuation Business Infographic

Pin By Shabicircle On Business Marketing Financial Ratio Money Management Advice Finance Investing

Save Money On School Supplies With This Free Printable Dozens Of Great Prices School Supplies Prices School Supplies Free School Supplies

How To Calculate Price To Sales Ratio In 2022 Fundamental Analysis Tricky Questions Stock Market Investing